|

|

|

|

||

|

|

Creating a Culture of Charitable Giving New Zealanders are considered generous people with approximately 1.3 million kiwis regularly donating their time, money, goods and services to charities and other non-profit organisations. In an effort to further encourage and reward charitable giving, the 2007 Budget created a basis for a stronger culture of charitable generosity, which has been affirmed and incorporated into our Income Tax Act 2007. Changes in recent years increased thresholds for tax deductions and protocols have been implemented that make philanthropic endeavours easier and more convenient.

Deduction Incentives

Individuals - All individuals that donate to charities will be able to claim a 33.33% tax rebate on the amount of cash donations. Previously, deductions for charitable donations could not exceed $630 regardless of the amount.

For example, Jack donates $3000 to charities and non-profit organisations in a year. His taxable income for the year is $35,000. Previously, Jack would only be entitled to a deduction of $630. The recent change now means that Jack is entitled to a rebate claim of $1000 being 33.33% of the $3000 in donations.

Individuals are also able to donate direct from their pay to their chosen charitable organisation(s). In doing so, individuals receive immediate tax credits that decrease their PAYE. Payroll giving is only possible when it is offered by the employer, and is limited to employers who electronically file their monthly PAYE schedule. The only other condition is that the chosen charity/organisation must also be one that is approved by the Inland Revenue Department.

Companies - All companies, even those with five shareholders or less, are eligible for tax deductions when they donate to charitable organisations (as described in the Income Tax Act 2007). Previously, companies could only claim a rebate for a sum up to 5% of their revenue. The 5% limit on deductions has now been removed and companies are entitled to deductions limited only by the company’s net income.

For example, in the 2008/2009 year ABC Ltd made charitable donations amounting to $10,000. Its income before taking into account the donations was $100,000. Previously, the deduction entitlement for the company would have been $5000. As of 2009, the company is entitled to a $10,000 tax deduction, which also reduces its taxable income to $90,000.

|

|

Inside this edition

Creating a Culture of Charitable Giving Changes to the Employment Relations Act Your Rights: Consumer Guarantees Act

Maori Authorities - Incentives for Maori Authorities are much the same as that of companies. These authorities will be able to claim deductions for cash donations made to charitable organisations limited only by the amount of their net income.

Conclusion Charitable and non-profit organisations play a crucial role in our communities and it is hoped that the recent changes will encourage and reinforce our culture of giving by providing tax incentives for individuals and organisations alike. It also puts New Zealand on par with other OECD countries such as Australia and the United Kingdom in terms of tax relief provisions for charitable donations. The Government estimates that donations will increase by $300 million a year from 2009, which will make up for the $16.2 million of lost revenue due to the law change. Deductions currently apply only to financial donations and do not extend to donations of goods or services.

|

|

|

|

|

|||

|

|

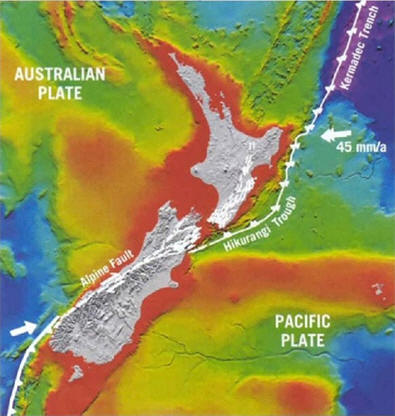

New Zealand is internationally renowned for it’s breathtaking and diverse landscape, however less publicised, until recently, is the fact that we are situated between two major fault lines. Consequently seismic activity is also an undeniable feature of life in our remarkable land. The recent Canterbury earthquakes are a timely reminder of this fact and in light of this here are some key points to keep in mind if you are a tenant, landlord or home-owner.

Residential Tenancies In the event of a natural disaster, the Residential Tenancies Act 1986 allows both the landlord and tenant to terminate the tenancy. Where a home has been damaged to the extent that it is uninhabitable, no rent shall be payable until the home is reinstated so that the tenant can re-occupy. Alternatively, the landlord or tenant may wish to terminate the tenancy. If a tenant wishes to terminate the tenancy, the landlord must be given at least two days notice. Where a landlord wishes to terminate the tenancy, the tenant must be given at least seven days notice. In situations where the home is partially damaged, the rent may be proportionately reduced or either party may apply to the Tenancy Tribunal for an order terminating the tenancy.

Commercial Leases The Auckland District Law Society (ADLS) Lease, the most commonly used commercial lease, allows for the termination of the lease in the event of a natural disaster. In situations where the damages render a property uninhabitable, the lease is terminated instantly. Where the damages are partial, rent shall be abated and the landlord is required to use insurance monies to repair damages as quickly as possible. If the necessary building consents are unobtainable and insurance payments are inadequate to facilitate a timely restoration, the lease is terminated. If premises are uninhabitable and require demolition or reconstruction, the landlord may cancel the lease giving the tenant 20 working days notice.

In the absence of a lease, the Property Law Act 2007 provides similar remedies in the event of specified natural disasters. Landlords can recover rental losses through their insurance providers if they are covered for loss of rent and outgoings.

|

|

Residential Property In the event of an earthquake or natural disaster, homes, personal possessions and land are automatically covered by the Earthquake Commission (EQC) - provided home-owners have pre-existing private and fire insurance policies. The EQC provides cover for:

Any value over and above these amounts may be covered under existing private insurance policies. Claims to the EQC need to be made within 30 days of the damage occurring but can be extended to three months in some circumstances. |

|

|

|

|

|||

|

|

Recent changes to the Employment Relations Act (‘ERA’) introduce legislative amendments aimed at promoting a more flexible relationship between employees and employers. The changes are to take effect on 1 April 2011.

Adjustments to Personal Grievance Regime Changes to the personal grievance regime are aimed at reducing compliance costs, improving resolution processes and reducing delays. The changes also create an interim step for dispute resolution before the authorities get involved. For example, one such change is that the Mediation Service is now able to make recommendations, which both parties have seven days to accept or decline, and if accepted the recommendations become binding.

The amendments also ensure that the Employment Relations Authority (‘the Authority’) acts more formally and consistently without jeopardising the investigative nature of its inquiries. The changes also allow the Authority to dismiss claims that are deemed to have no merit, and allows parties to cross examine witnesses during Authority investigations.

|

|

90-Day Trial Period

Another major

change is the extension of the 90-day trial period to all employers, which was

previously limited to employers with 19 staff or less. Statistics showed that

40% of employers said they would not have employed new staff if it was not for

the 90-day trial period, and 75% of all job-seekers who worked under the trial

period maintained their employment. As a result, the trial period allowed more

job-seekers to enter the workforce as more employers were willing to hire new

staff. The purpose of extending the 90 day trial is

therefore to extend such benefits to a wider range of employers and employees.

|

|

|

|

|

|||

|

|

Background Gift duty was established in 1885 with the purpose of protecting the estate duty base (through discouraging individuals from gifting away their assets prior to death) and to raise revenue. Estate duty was abolished in 1992, however, gift duty was preserved to guard against people taking advantage of social assistance regimes and provide protection to creditors.

Reasons for Abolishment The abolishment has received broad approval from a range of government agencies including the Inland Revenue Department (IRD), New Zealand Treasury and the Ministry of Social Development. The key motivations for the abolishment stem from a review by the IRD highlighting that gift duty generated exceedingly high compliance costs of $70 million compared to the meagre revenue generated ($1.6 million in the 2009/2010 year). It was also noted that gift duty was easily avoided through the use of gifting programmes and therefore no longer remained an effective tool. It also follows a large number of requests for thresholds to be raised and for the modernisation of administration processes. |

|

Concerns and Cures There are concerns that the abolishment of gift duty will see a significant rise in the creation of trusts and an increase in the number of transfers of assets into trusts. Concerns over ‘social assistance targeting’ relate to individuals deliberately impoverishing themselves to avoid assets being included in their assessment for social assistance, relationship property or to escape creditor liability. However the IRD, in its agency disclosure statement, deemed these risks as low and have suggested policy changes to counter any abuse of trusts – such as the Ministry of Social Development taking into account any asset transfers within the past five years of an applicant applying for social assistance. The family courts are also more closely scrutinising trusts with regard to relationship property matters, and claimants access to those assets. Concerns that the repeal will affect creditor protection in the event of a debtor going bankrupt has been deemed insignificant as other means of protection are readily available through the Insolvency Act, Companies Act and Property Law Act.

The establishment of a Trust Register, and requiring trustees to file annual financial statements, have also been recommended to the Law Commission for review as a means of monitoring and regulating trusts in New Zealand.

Conclusion Despite concerns regarding the abuse of trusts, the IRD deems the risks entailed with the abolishment of gift duty as arguably insignificant and heavily outweighed by the monetary benefits generated. It predicts that with the co-operation from affected agencies and implementation of the recommendations from the recent review of NZ Trust Law, any loop-holes will quickly be sealed.

For more information on this subject, please visit www.taxpolicy.ird.govt.nz/publications/2010-ris-gift-duty/gift-duty-repeal

|

|

|

|

|

|||

|

|

The Consumer Guarantees Act 1993 (‘the Act’) provides guarantees for consumers on goods and services ordinarily acquired for personal, domestic and household use. The Act also applies to gifted goods and services. The Act imposes on retailers, manufacturers and service providers automatic guarantees ensuring that:

Manufacturers have the added obligation of ensuring spare parts and repairs are available for a reasonable time after purchase and any written warranties are honoured. No trader can contract out of the Act unless the trader is supplying to a business.

Redress If a defect is discovered in a good or service, and it is relatively small, the retailer can choose to either repair, replace or refund the affected good or service provided the fault is remedied within a reasonable timeframe. If the defect cannot be restored in a timely manner or the defect is substantial, the consumer has the right to reject the product or service. |

|

Substantial defects in good and services are where:

In rejecting the good or service, the consumer is entitled to choose a replacement of a similar type or value, or they can demand a full refund of the purchase price. Any refund must be in cash, cheque or credit card reversal. The Act also allows consumers to cancel service contracts and claim for compensation for any decrease in value of the product or service.

Consumers can also claim for losses that are reasonably foreseeable and are causally linked to the breach of a guarantee. For example, if a new lawnmower is faulty, the consumer can claim for lawn-mowing services or hiring a replacement lawn-mower while the original mower is being repaired. In situations where a retailer is not co-operative or has ceased to trade, consumers can lodge a complaint to the manufacturer. Consumers can also direct their concerns to the Disputes Tribunal, the Commerce Commission or any relevant industry body complaints service. So next time a retailer tells you “we have a no returns/refund policy”, politely remind them their policy is unlawful. Even if the items are on sale/clearance, they are subject to all the guarantees provided under the Act.

|

|

|

Snippets |

||||

|

|

Changes to the Holiday Act

As of April 2011:

· employees will be able to exchange up to one week of annual holiday for cash provided their employer agrees to the request, · employees will be able to transfer the observance of a public holiday to another predetermined working day with the employer’s consent, · for employees that have irregular hours and/or pay, the payment for sick leave, bereavement leave, public holidays and alternative holidays will be based on the average gross earnings for the previous 52 weeks or whatever lesser period the employee has been employed, · employers will be able to request proof of sickness within the first three days of an employee being away on sick leave. Employers are to cover reasonable costs, such as doctor’s fees, in obtaining such proof.

A guide to the changes will be available at www.dol.govt.nz before April 2011. |

|

Email Disclaimers Email disclaimers have become the norm for many businesses and organisations. But are they legally binding?

The Electronic Transactions Act 2002, Section 8, validates all electronically transmitted data/information and gives it the same standing as a written document. Arguably therefore there is no reason, in theory, why a properly constructed email disclaimer could not be legally enforceable.

To increase the likelihood of legal enforceability, the disclaimer must be worded appropriately and must be practical in the sense that it is ‘sufficiently drawn to the attention of the recipient’. Things to consider are the text size, font and placement/format of the disclaimer in the email. Placing a disclaimer at the top of an email rather than at the bottom is perhaps a better alternative.

Disclaimers are unlikely to have legal force unless they contain confidentiality obligations. The inclusion of confidentiality and legally privileged clauses is therefore highly recommended as it gives the disclaimer more weight by placing the reader ‘on-notice’. In situations where sensitive information is sent to the wrong recipient, a court order can be sought either demanding the recipient delete the email and/or prohibiting publication.

|

|

|

|

If you have any questions about the newsletter items,

please contact me, I am here to help. Simon

Scannell S J

Scannell & Co - Phone:

(06) 876 6699 Fax: (06) 876 4114 Email:

simon@scannelllaw.co.nz All information in this newsletter is to the best of the authors' knowledge true and accurate. No liability is assumed by the authors, or publishers, for any losses suffered by any person relying directly or indirectly upon this newsletter. It is recommended that clients should consult S J Scannell & Co before acting upon this information. |

|

||